Put On Your Blue Overalls – the Key to a Successful Acquisition

Over the last several years, I’ve met and worked with many executive teams with extensive experience in mergers and acquisitions. But when it comes to sheer…

You’re familiar with the business case for a merger or acquisition: economies of scale, increased market share, differentiated revenue streams, new products and technologies.

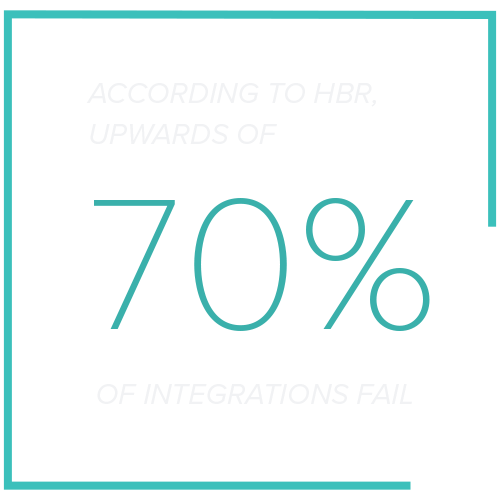

But too often the potential of the deal is undermined by a disconnected strategy, an overwhelmed leadership team, and a culture unprepared to sustain the transition.

And with the pressurized timeline and heightened stakes of the post-merger environment, the situation can devolve quickly.

So—how can you align your stakeholders in the transitionary period in a way that reduces suffering, mitigates risk, realizes the value of the deal?

Acquirers do copious due diligence pertaining to valuation, projected financials, contingent liabilities, intellectual property.

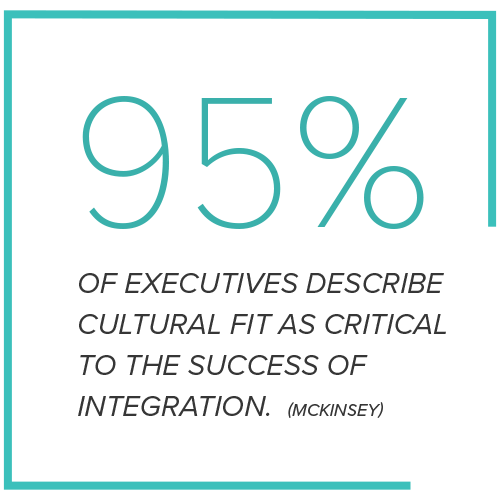

Often, though, little consideration is given beyond the raw economics and systems integration of the deal to the challenge of bringing together companies with distinct cultures and identities. The human element of change—how people are impacted in the course of the transition—gets short shrift.

The result: tension, turnover, burnout, and operational inefficiency.

TGN Consulting partners with you during all stages of the pre- and post-integration process to intentionally address cultural blind spots, equip your leadership team, and move with purpose and precision towards M&A outcomes.

TGN Consulting Framework™ takes strategy, leadership, and culture as interdependent phenomena to be impacted in lockstep as you navigate a merger or acquisition:

CULTURE – Identifying “the way we do things”—what we value, how we relate, how we get things done, how we interpret situations—in both the acquiring/acquired entities, and generating a unified culture for a new era.

LEADERSHIP – Equipping leaders with tools to advance, shape, and intervene in key conversations that contribute to performance during the integration process, and lead new colleagues and integrated work-centers through big changes.

STRATEGY – Ensuring that the strategic objectives of the deal are coherent with the leadership and culture.

An industry-leading national healthcare company emerged from a key acquisition with:

Over the last several years, I’ve met and worked with many executive teams with extensive experience in mergers and acquisitions. But when it comes to sheer…

A couple months ago I facilitated a roundtable discussion with an intimate group of CEOs of primarily publicly traded companies. Our dialogue focused on the importance…

My firm was called in to integrate two large regional healthcare companies merging into one. As part of the integration, the acquired company would adopt the…